Content

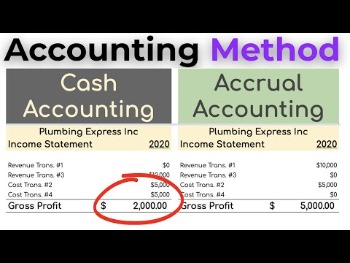

It details the worker’s information, type of work performed, wages, benefits, and hours worked. On California prevailing wage projects, the form typically used is form A-1-131. Generally speaking, California prevailing wage law is more stringent than its federal counterpart. For example, California has https://quick-bookkeeping.net/ a lower threshold for triggering prevailing wages. This means construction projects with a prime contract of $1,000 or more will be subject to the compliance requirements; hereas on the federal level, the project needs to meet a higher threshold of $2,000 before Davis-Bacon requirements kick in.

For those who work in construction and repair, it’s essential to know how to submit certified payroll reports. The US Department of Labor demands this type of documents to ensure that contractors pay fairly the workers involved in government-funded public works projects. Contractors and subcontractors that work on qualifying government contracts that fall under DBRA, SCA or local prevailing wage laws are required to do certified payroll. Federally assisted contracts, where federal and local dollars are combined, also fall under these rules. Contracts must meet a certain dollar amount to trigger these regulations.

How to keep certified payroll reports organized

This is to be done for each plan for which the employee is enrolled. In order to assure special treatment of a request where this circumstance exists, a note explaining the special circumstances should be made in the project description block of the SF-308. Information on wage rates paid to apprentices and trainees is not reflected in Davis-Bacon wage determinations. Similarly, their addition through the additional classification procedure is neither necessary nor appropriate. On projects funded by the Federal-Aid Highway Act, apprentices and trainees certified by the Secretary of Transportation are not covered by Davis-Bacon labor standards.

There is nothing in the federal regulations that says an employer must provide coverage to their employees. Employers, again with 50 or more full-time equivalent employees, who do not offer their employees’ health insurance coverage could face a penalty of $2,000 per employee . The total penalty for not offering affordable coverage cannot exceed the penalty for not offering insurance coverage at all.

Compensation for Public School Employees

That means you’ll have to pay whichever rate is higher – the federal or state. In accordance with the provisions of 29 CFR Part 1 and Part 5, the wage rates and fringe benefits in the applicable Davis-Bacon wage determination shall What Is Certified Payroll? 2021 Requirements And Faq be the minimum paid by contractors and subcontractors to laborers and mechanics. If you’re a contractor for public works projects, Complete Payroll Solutions can help you stay compliant with the requirements of the Davis Bacon Act.

You many also be investigated by a federal or state agency and face legal and financial penalties. The proper wage rates to be paid to apprentices and trainees are those specified by the particular programs in which they are enrolled, expressed as a percentage of the journeyman rate on the wage determination. This applies regardless of work classifications which may be listed on the submitted payrolls and regardless of their level of skill. Again, much like Davis-Bacon covered work, if you’re an awarding body or public agency , you’re responsible for enforcing compliance by making sure contractors are paying their workers prevailing wages. This entails collecting and verifying certified payroll reports and other required compliance documentation from contractors, among other responsibilities.

What is the most efficient way to help ensure California prevailing wage and certified payroll requirements are being met?

Additionally, each state has an agency that oversees labor issues. For example, contractors and subcontractors in California must go through the Department of Industrial Relations. Texas companies doing prevailing wage work fall under the Texas Workforce Commission . Infrastructure projects, including building highways and bridges, are considered public works projects. These types of projects are generally subject to prevailing wage laws like DBRA or local regulations as long as they meet the minimum dollar threshold.

- A sufficiently detailed description of the project to indicate the type of construction involved.

- If the materials studied are based on different sets of federal laws and regulations then RCHs can be earned for both study groups.

- Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

- Payrolls and basic records relating thereto shall be maintained by the Contractor during the course of the work and preserved for a period of 3 years thereafter for all laborers and mechanics working at the site of the work.

Specifically, we can provide you signature-ready federal certified payroll reporting. In addition, we can provide reports in a growing number of states for state-funded projects.Learn more about staying fine-free by visiting our dedicated payroll page to learn more about our outsourced payroll services. Note that federal projects in Ohio are subject to Davis-Bacon Act requirements, which establish prevailing wages for US government contracts. These rates differ from prevailing wage rates on state projects, as they are set by a different authority.