Refer to the total variable manufacturing overhead variance in the top section of the template. Total standard quantity is calculated as standard quantity of the cost driver per unit times actual production, or 0.25 direct labor hours per unit times 150,000 units produced equals 37,500 direct labor the founders guide to startup accounting hours. The standard variable manufacturing overhead rate per direct labor hour was established as $3. Total variable manufacturing overhead costs per the standard amounts allowed are calculated as the total standard quantity of 37,500 times the standard rate per hour of $3 equals $112,500.

Do you already work with a financial advisor?

On the other hand, if actual inputs are less than the amounts theoretically required, then there would be a positive efficiency variance. Since the baseline theoretical inputs are often calculated for the optimal conditions, a slightly negative efficiency variance is normally expected. Overall, efficiency variance is a vital metric for any manufacturing company that wants to remain competitive in today’s market.

Capacity and Capabilities – When Should a Company Consider Investing in New Equipment

This can involve analyzing production data, customer feedback, and other relevant information. Employees must be trained on the latest processes, technologies, and best practices for improving efficiency. This can include equipment operation, quality control, and waste reduction training. Inadequate quality control can result in defective products, rework, and increased costs. This can occur when quality standards are not correctly defined or lack monitoring and enforcement.

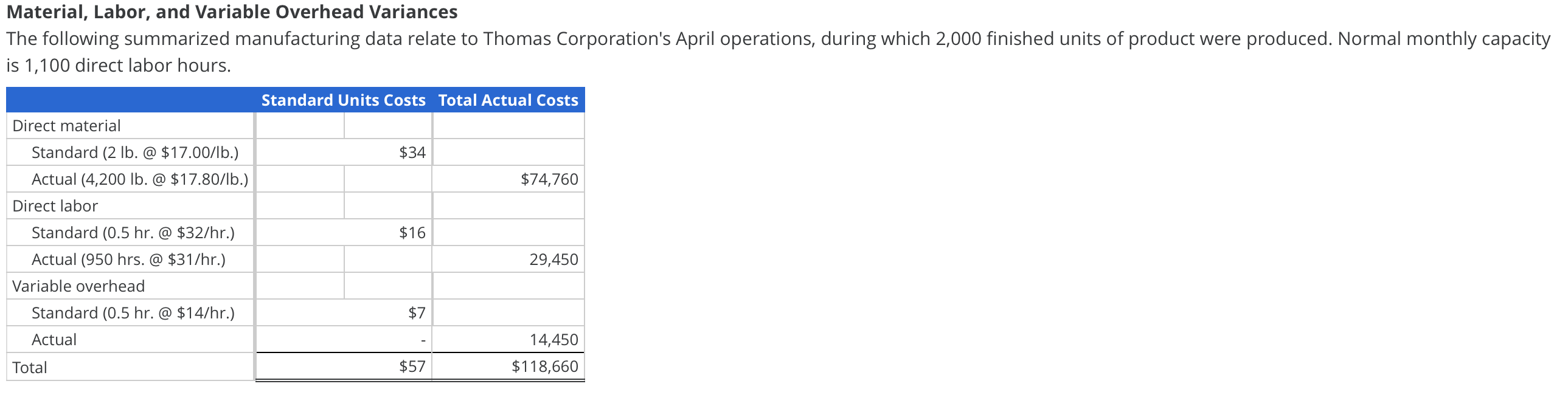

Determination of Variable Overhead Variances

Actual data includes the exact number of units produced during the period and the actual costs incurred. The actual costs and quantities incurred for direct materials, direct labor, and variable manufacturing overhead are reported in Exhibit 8-1. In our example, DenimWorks should have used 278 yards of material to make 100 large aprons and 60 small aprons. Because the company actually used 290 yards of denim, we say that DenimWorks did not operate efficiently. When we multiply the additional 12 yards times the standard cost of $3 per yard, the result is an unfavorable direct materials usage variance of $36. In this case, the actual price per unit of materials is \(\$9.00\), the standard price per unit of materials is \(\$7.00\), and the actual quantity used is \(0.25\) pounds.

Sweet and Fresh Shampoo Overhead

Efficiency variance can also provide valuable insights into the performance of specific departments or processes within a company’s operations. It may also be that our expectations are unrealistic, and we need to change our budget parameters. Standard costs are sometimes referred to as the “should be costs.” DenimWorks should be using 278 yards of denim to make 100 large aprons and 60 small aprons as shown in the following table. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Encouraging cross-training among employees can help to increase their knowledge and understanding of the entire manufacturing operation.

How confident are you in your long term financial plan?

- If the result is negative, the efficiency variance is unfavorable because the actual quantity used is more than the budgeted quantity.

- The third step is to find the actual output achieved during the measuring period.

- That part of a manufacturer’s inventory that is in the production process and has not yet been completed and transferred to the finished goods inventory.

This involves calculating the cost of the new equipment and estimating the savings resulting from increased efficiency, reduced variance, and improved productivity. Proper maintenance of equipment is essential for reducing efficiency variance. Equipment should be regularly inspected and maintained to perform at peak performance. This can help to reduce breakdowns and downtime, improve efficiency, and extend the life of the equipment. This involves regularly reviewing processes and procedures to identify areas for improvement and implementing changes to address any issues.

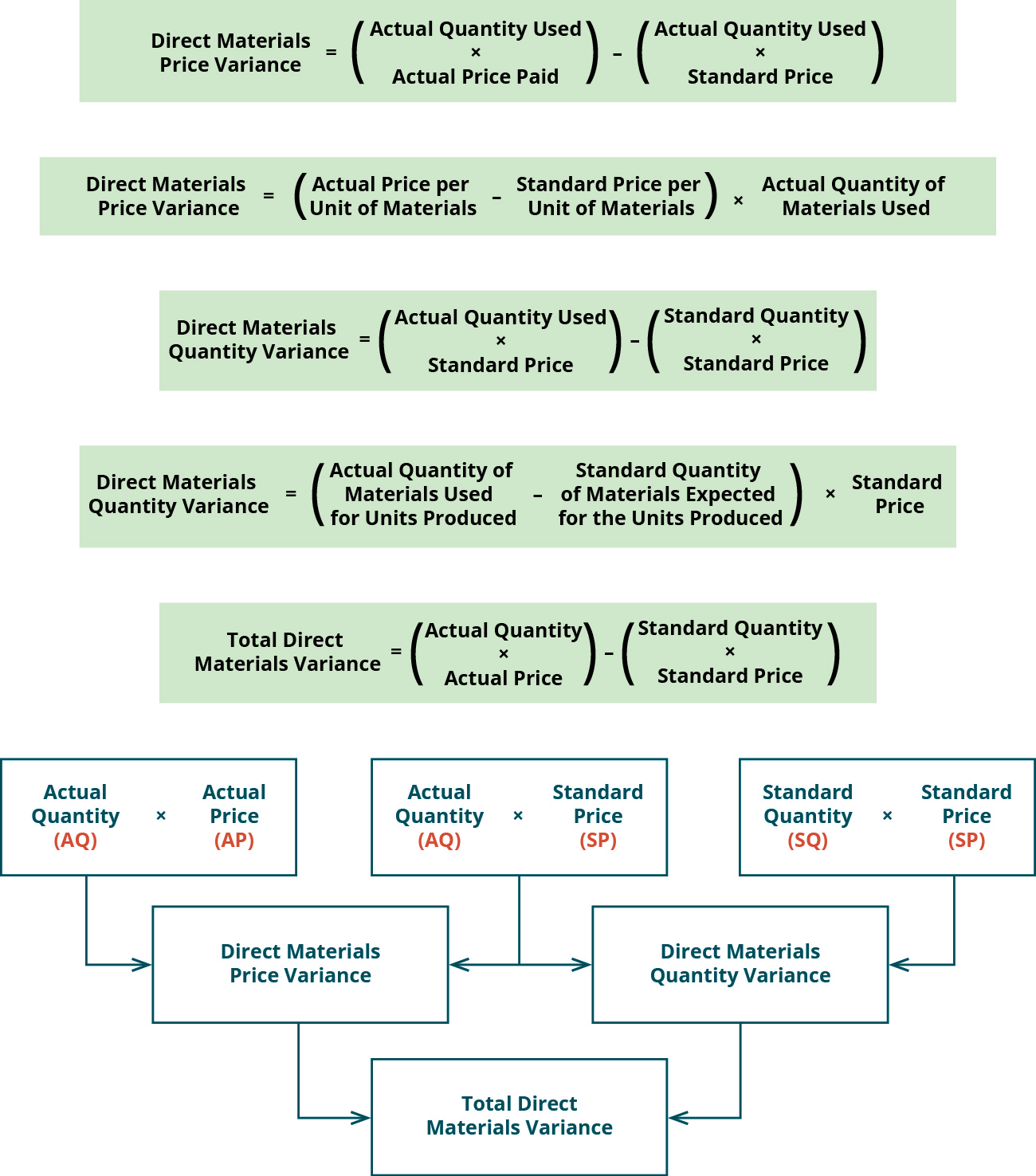

This variance is calculated by subtracting the standard labor hours from the actual labor hours and multiplying the difference by the standard hourly rate. A positive labor efficiency variance means the company has used fewer labor hours than expected, indicating that its employees are working efficiently. The combination of the two variances can produce one overall total direct materials cost variance.

For example, rent expense for the production factory is the same every month regardless of how many units are produced in the factory. Within the relevant range of production, fixed costs do not have a quantity standard, only a price standard. Fixed manufacturing overhead is analyzed by comparing the standard amount allowed to the actual amount incurred. The completed top section of the template contains all the numbers needed to compute the direct labor efficiency (quantity) and direct labor rate (price) variances. The direct labor efficiency and rate variances are used to determine if the overall direct labor variance is an efficiency issue, rate issue, or both.

Even though the answer is a positive number, the variance is unfavorable because more materials were used than the standard quantity allowed to complete the job. If the standard quantity allowed had exceeded the quantity actually used, the materials usage variance would have been favorable. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. That component of a product that has not yet been placed into the product or into work-in-process inventory.

In this case, the efficiency variance is unfavorable because the actual quantity of raw material used is less than the budgeted quantity, resulting in a negative value for the variance. IoT refers to using connected devices to gather and analyze data about various aspects of a manufacturing process. The operations manager works closely with the production manager to ensure that production processes are optimized and that efficiency variance is minimized. They also work with other departments, such as finance and marketing, to ensure that operations are aligned with the company’s overall goals.

The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Throughout our explanation of standard costing we showed you how to calculate the variances. In the case of direct materials and direct labor, the variances were recorded in specific general ledger accounts.