The EMS is more agile and may adapt extra quickly than the OMS in today’s quickly altering capital markets, and some companies may find their skills to be extra priceless and practical for their wants. An execution management system (EMS) is a buying and selling What is Order Management System utility that has the ability to manage orders throughout multiple trading destinations, in a broad range of asset classes. EMSs can be thought-about a next technology direct market access (DMA) platform.

Optimize Stock Control With Zoho Stock

Some of the most common order-routing network distributors embody Bloomberg, Reuters, ITG Net, NYFIX, SunGard, TNS, Thomson ATR, Linedata, and Charles River. Service Bureau (Protocol Conversion) – Orders are despatched to the order routing network vendor who converts the order to the right message format for each dealer or execution venue. Point-to-Point – Orders are sent over a network instantly to each broker or execution venue. Discover the most recent developments, learn how your peers are accelerating their digital transformations, get updates on evolving merchandise, and extra. Use our OMS to apply commonplace multi-level allocation rules through pro-rata, goal proportion, and customizable workflow.

The Following Are A Few Of The Companies We’ve Been Privileged To Assist:

During authorities service, he served within the State and Central governments; started the state-owned Mysore Sales International, now a multimillion dollar trading firm; retired early as Joint Secretary from the Ministry of Defence. Worked extensively on international collaborations and joint ventures while in the government and also later. Because of their ability to impact the pure price discovery strategy of traditional markets, darks pools have drawn consideration from regulators. A part of Regulation National Market System (Reg NMS) focuses particularly on dark pools and states that any buying and selling venue accumulating more than 5% of US fairness quantity should provide open quotes to the broad market. Some extra advantages provided by a compliance module embody post-execution monitoring, audit trails and compliance administration.

Breaking Via Bottlenecks: Driving Effectivity And Precision In Nav Management

- All HyperSync parts run on CentOS, whether or not on bare-metal or virtualized.

- These analytics try to analyze market influence, compare trade execution to the portfolio manager’s instructions, and examine the execution along side various portfolio or firm benchmarks.

- Point-to-Point – Orders are despatched over a network directly to every broker or execution venue.

Enhancing technological infrastructure, buying information caching options, putting in hardware accelerators and co-locating servers are among the many most popular methods to reduce latency. Co-locating consists of a dealer housing their algorithms and servers in the same room, or as intently as potential, to the actual servers of the exchanges and digital markets. This course of can get rid of even probably the most imminent time lags in the fastest area extensive networks. Latency has evolved to be a key differentiator and aggressive benefit for brokers in capital markets, and most corporations are wanting hard for ways to chop out microseconds of their commerce execution workflows. Wisdom Capital’s ardent endeavour is to supply its esteemed customers quality investment services based mostly on meticulously researched investment methods to add worth to their cash.

Getting Forward Of The Curve: Kind Sho For Sec Brief Sale Reporting

The company has Offices in Bangalore, Mangalore, Kolkata, Delhi and Mumbai and just lately acquired by Thomson Reuters by Sep 2013. Dark pools are electronic buying and selling venues that do not publicly display quotes. Orders are matched anonymously, usually at the midpoint price or through negotiation with a counter party, and are typically carried out with minimal market impact.

Why Ratio Spreads Are A Game-changer For Crypto Merchants In Unstable Markets

The staff has also built-in ASBA IPO for bank brokers, which benefited retail purchasers by allowing them to block the amount in their Savings account for subscribing to an IPO concern. This feature ensures that the blocked quantity can’t be used for some other objective and continues to earn interest till successful allotment. Rupeeseed’s platform can also deal with Non-ASBA processes by way of UPI and NEFT Mode (Pl examine this) , which debit the applying money from the checking account as soon as the bid application is successfully placed. Comprehensive Thematic Investment Capability, with support for multi-provider themes, tracking of investment performance, rebalancing of baskets, SIP based mostly investments, and so on. After over 20 years within the Indian Administrative Service (IAS), during which he headed numerous main public sector firms, he arrange O.M.S. in 1974, primarily based in New Delhi.

Wisdom Capital’s mission is to pursue long-term relations with its clients by offering competitive business terms, latest expertise based infrastructure and well-researched data to boost their investment determination making. Order management system (OMS) is a software program system that facilitates and manages the execution of commerce orders. In the monetary markets, an order should be placed in a trading system to execute a purchase or promote order for a safety. Partner with multiple wealth managers to grow your corporation while buying and selling from a single, seamless interface throughout wealth managers, purchasers, countries and merchandise.

Once a buying and selling determination is made, the portfolio supervisor will authorize the commerce and ship it electronically to a dealer. IVP for Private Funds helps private fund managers to automate deal lifecycle management, enhance portfolio administration, and improve analytics & reporting. Configure ticket fields, layouts, and calculations for all different asset lessons. Successful commerce execution calls for worth discovery in microseconds while the information nonetheless reflects the actual market.

With the development of the quite a few darkish swimming pools of liquidity, fragmentation has become a priority. To address this, many providers are linking instantly with each other along with offering access to their liquidity via algorithms. The problem here is that finest execution policies and order routing algorithms range vastly from firm to firm, often finest execution policies are unstructured content material that information business selections to be made.

We offer expertise based providers for our clients to effectively monitor their portfolio and help them attain their financial objectives. Our Mission is to make investing and buying and selling in stock markets easy and rewarding for you. We make this possible by bringing you know-how driven, easy yet clever options that allow you to invest or trade at virtually zero value. We wish to deliver you the best, know-how pushed, investing and buying and selling instruments that equip you with the relevant info to take proper selections at the right time. The Prithvi Group is a specialised Institutional Dealing and Retail Broking agency with an exemplary track document of cutting-edge analysis, service innovation, transaction execution and solution structuring.

The IVP Order Management System solution has been stress-tested for greater than 50 parallel customers. The OMS platform helps bulk uploads of greater than 10,000 trades, more than 10 parallel bulk load threads, and auto-creation of more than 15,000 new securities, together with underliers. It’s tough to handle orders with out having a correct system in place, as a outcome of it requires you to manually update your inventory ranges every time you get an order. This becomes particularly difficult for companies that cope with a quantity of products, warehouses, and branches. Apart from being tedious and time-consuming, handbook updating implies that you won’t be ready to see your stock change in actual time.

OMNESYS NEST™ is utilized by greater than 200 of the top establishments in India in addition to various exchanges which offer OMNESYS NEST™ as a entrance office service to their prospects. The software as a service mannequin is out there to all of the members of the exchanges and covers the complete buying and selling community. Algorithms have developed from time and quantity primarily based strategies to extra adaptive methods. Recent developments in algorithmic trading methods include darkish pool algorithms and portfolio algorithms that bear in mind an entire portfolio of securities. Algorithmic buying and selling has become more and more well-liked over the previous several years.

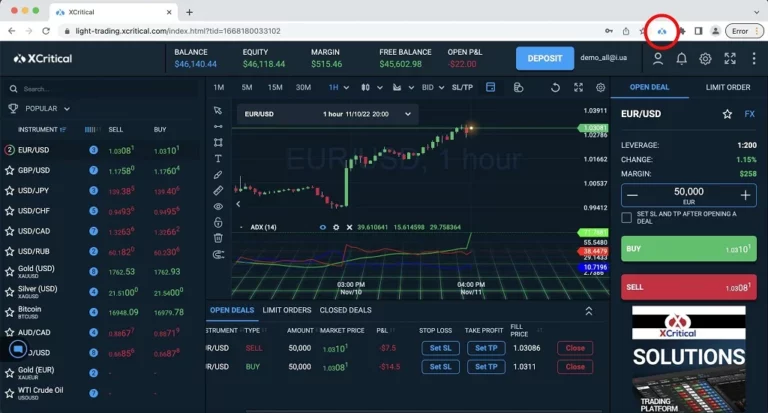

Read more about https://www.xcritical.in/ here.